Barriers to E-Banking Acceptance by Moroccan Students:

An Exploratory Study at Hassan First University

Table des matières

Texte intégral

1Abstract

The aim of this research is to identify the factors obstructing the acceptance of e-banking by university students in the Moroccan context. To achieve this goal, we refer to the Technology Acceptance Model, to which four variables have been introduced: security and confidentiality, previous experience of use, quantity of information and need for human interaction. To test the hypotheses formulated through the variables of the conceptual model, a quantitative study is conducted by means of a questionnaire administered to 200 students' non-users of e-banking at Hassan First University of Settat. The results revealed that security and privacy as well as the need for human interaction are the main barriers to acceptance of e-banking by the different respondents.

Keywords: Innovation, Information and Communication Technologies, E-banking, Acceptance.

Introduction

2The digital revolution and technological change have led to significant changes in all sectors, including the banking sector. These advances have given rise to a new form of business, in which the presentation and delivery of products and services are done online, and the relationship is at a distance; this has implied a change in consumer habits and behavior, "today's customers are different from yesterday's customers". They are becoming more connected and closely linked to their electronic devices, thus engaging in new consumption and purchasing practices. In order to adjust to the changing environment, to maintain a strategic advantage, and to meet the new and growing needs of their customers, banks have opted for a new way of providing banking services: they have adopted e-banking.

3Stamoulis (1994) defines e-banking as "a channel for the distribution and delivery of banking services by means of multimedia communication, in a comprehensive and less costly manner", i.e. a form of banking through which a customer can carry out a banking transaction without having to go to the branch where his or her account is maintained. No one would have thought that one day a bank would be able not only to maintain a direct and close relationship with its customers in the branch but also to go as far as the possibility of staying in touch with them outside the branch thanks to technology.

4 E-banking began in Great Britain with the setting up of the "Homelink" system by the Nottingham Building Society in 1983 and subsequently emerged in the USA, France and some African countries (Merbouti and Mestour, 2020). In Morocco, banks have also understood this and have invested a lot since the 2000s to follow the trend. E-banking has dematerialized services and the banks that have adopted it offer a wide range of services such as consulting bank balances online, bank transfers via telephone or PC, requesting chequebooks, issuing electronic cheques, and consulting operations carried out by bank cards. Permanence, service without slow and cross-border service, the possibility of managing several bank accounts via a single site are some of the advantages of e-banking. However, it is very little used by Moroccan banking customers, who still show resistance to its acceptance, even university students who are more prone to accept and adopt new technological advances. Accordingly, it is crucial to identify tools and technics to promote the acceptance of e-banking by Moroccan banking customers. To this end, this paper aims at identifying the factors that inhibit the acceptance of e-banking by Moroccan banking customers. First, it presents a brief review of the literature on the acceptance of e-banking; then, the methodological approach adopted as well as the results obtained and their discussion are presented.

Literature review and development of hypotheses

5As mentioned in the introduction, we are now getting to the important aspect of our paper by debriefing the literature review and hypotheses’ development. With regard to this, it will be a question of highlighting in turn the context, and the formulation of the various hypotheses.

Context

6Studies on the acceptance of information systems in general and e-banking systems, in particular, have led to the development and use of several theoretical models. They include:

-

The Theory of Reasoned Action (TRA) of Fishbein and Ajzen (1975)

-

The Theory of Planned Behavior (TPB) of Ajzen (1985;1991)

-

The Technology Acceptance Model (TAM) of Davis (1986)

-

The Theory of Interpersonal Behavior of Triandis (1980)

-

The Unified Theory of Acceptance and Use of Technology (UTAUT) of Venkatesh et al. (2003); to name only the most commonly used.

7They have suggested various representations of the acceptance of information and e-banking systems. A representation through which the acceptance of information and e-banking systems is perceived as a phenomenon influenced by independent variables of various nature such as attitude, expected performance, perceived usefulness, social influence, usage experience, perceived fun, perceived anxiety, willingness, perceived risk, quality of services, quantity of information, knowledge of the internet and the use of new technologies and many more.

8These models and theories have been used in several research studies. The first is the one conducted by Hosein in 2009, which attempted to identify the factors that significantly and negatively influence the acceptance and use of internet banking in the Midwest in the USA. The author relied on the Technology Acceptance Model (TAM) of Davis (1986) to develop his conceptual model. Following the collection of 325 questionnaires, the results of structural equation modelling confirmed that independent variables such as "perceived ease of use, stimulation, internet banking knowledge, internet experience, and internet usage" have a significant influence on internet banking acceptance in the USA. In a second study, Luarn and Lin in 2005 mobilised the TAM to which they added four other variables: trust, self-efficacy, financial cost, and perceived credibility in order to investigate factors obstructing internet banking in Taiwan. Following an analysis of data from 180 questionnaires, the results confirmed the significant effect of "perceived self-efficacy, financial cost, perceived credibility, perceived ease of use and perceived usefulness". Similarly, a study by Sheng et al. in 2011 on factors inhibiting acceptance of online banking in Taiwan found a significant influence of 'perceived risk'. Davis (1986) uses the TAM to determine the explanatory factors for resistance to mobile banking adoption in Morocco, Zohra Filali and Brahim Kirmi (2017) found that "perceived risk" is the main one.

Hypotheses’ Development

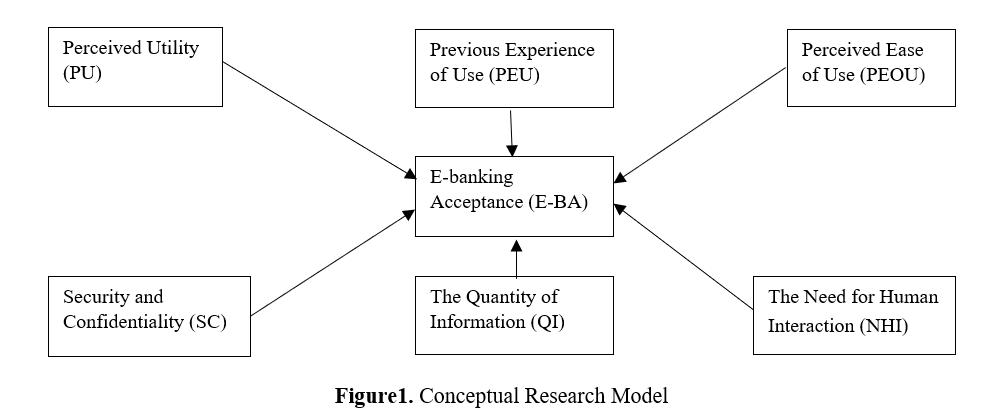

9The exploratory study conducted leads to the formulation of six hypotheses.

-

Perceived Utility (PU) :

10Davis (1989) defines perceived usefulness as "the degree to which a person believes that using a system would improve his or her job performance". The less beneficial the use of e-banking is for an individual, the more sceptical he will be about its acceptance.

11H1: Perceived Usefulness significantly and negatively influences the acceptance of e-banking by university students.

-

Perceived Ease Of Use (PEOU):

12According to Davis (1989), perceived ease of use is defined as "the degree to which a person believes that using a particular system would be effortless". The more difficult a technology is to use and learn, the less acceptance it will have among users.

13H2: Perceived Ease of Use significantly and negatively influences the acceptance of e-banking by university students.

-

Security and Confidentiality (SC) :

14Giglio (2002) defines security and privacy as "the extent to which a technology is perceived as reliable by customers". If individuals find that security and privacy problems are recurrent when using a system other than e-banking, they will be discouraged from accepting the e-banking system as well for fear of facing the same problems. "Security and privacy are a main obstacle to acceptance of e-banking" (Sathye, 1999).

15H3: Security and Confidentiality significantly and negatively influence the acceptance of e-banking by university students.

-

Previous Experience of Use (PEU):

16If an individual has a bad previous experience of using any system, he or she will be discouraged from using another, especially e-banking.

17H4: Previous Experience of Use significantly and negatively influences the acceptance of e-banking by university students.

-

The Quantity of Information (QI):

18It refers to the knowledge that banks give about e-banking. Sathye (1999) states that "a low amount of information on e-banking negatively influences acceptance behaviour".

19H5: The Quantity of Information significantly and negatively influences the acceptance of e-banking by university students.

-

The Need for Human Interaction (NHI):

20Dabholkar (1992) defines the need for human interaction as "the desire to maintain personal contact during the service offering". Indeed, the customer and the service provider need to interact and this interaction is eliminated by the use of e-banking. Srijumpa, Chiarakul and Speece (2007); Marr et Prendergast (1993) believe that the lack of human interaction is an obstacle to e-banking.

21H6: The Need for Human Interaction significantly and negatively influences the acceptance of e-banking by university students.

Research methodology

22In this section, it will be a question of showing the framework of our research model and the approach adopted.

Research model or research design

23The above hypotheses lead to the following conceptual research model:

24In order to achieve the following objective “determining the factors that hinder the acceptance of e-banking by Moroccan university students”, a quantitative study is carried out based on a questionnaire administered to 200 students possessing bank accounts and who are not users of e-banking in Hassan First University of Settat. Subsequently, structural equation modelling is performed on the collected data using the SmartPLS software.

Sample and Statistical Analysis

25The sample of the current study consists of 200 respondents chosen randomly without any bias towards customers of a specific bank. The survey involved students possessing bank account who do not use online banking services. Structural equation modelling is used to achieve its main objective; it is a confirmatory statistical method whose purpose is to test a theory about a given phenomenon (Byrne, 2016). Structural equation modelling goes through two (02) main steps:

-

Assessment of the measurement model and,

-

Assessment of the structural model

26Evaluating the measurement model, i.e. evaluating the variables with their indicators in order to identify which indicators should be retained or deleted, consists of evaluating the degree of collinearity between the indicators as well as their significance and relevance. The level of collinearity is assessed through the Variance inflation Factor (VIF) which must be less than five. If the VIFs are higher than five, it implies the existence of collinearity between the indicators which biases the results; the evaluation of the structural model cannot be done.

27In order to obtain satisfactory results, the indicators must not be collinear (VIF must be less than five). This is especially true because only reflexively measured variables can admit collinearity between indicators since they are interchangeable. To ensure the significance and relevance of the indicators, the values of the external weight must be significant, i.e. they must be less than 0.05, and the values of the external load must be greater than 50%, i.e. 0.5.

28As for the evaluation of the structural model, it simply consists of analysing the existing relationships between the different variables, which is achieved by observing the p-values, which must be less than 0.05, and their signs (signs placed in front of the beta coefficient (β) of each variable). Furthermore, the structural model allows the confirmation and rejection of the developed hypotheses. After passing these two steps, the R2 must be calculated. The R2, which is the coefficient of determination, indicates the goodness of fit of the model as well as its predictive relevance. The R2 is between 0 and 1; the higher it is, the better the fit of the model and the higher the predictive accuracy. Generally, R2 values of 0.75, 0.50 and 0.25 can be considered large, moderate and small respectively (Hair et al., 2011; Henseler et al., 2009).

Results and discussion

29After having travelled all this way by highlighting the context, the development of various hypotheses and the methodology of the research, we must now talk about the results obtained as well as their interpretations.

Descriptive statistics

30The study’s sample comprises 200 university students. The respondents are of different genders, different age groups, and different educational levels. Out of the 200 respondents, 48% are men and 52% are women. Respondents aged between 18 and 24, 25 and 34 years old constitute the majority of the respondents with respective percentages of 27% and 26%. The rest of the respondents are aged between 35 and 44 years old (i.e. 19%), between 45 and 54 (i.e. 15%) and over 55 years old (i.e. 13%). In terms of educational level, the majority of the respondents has a PhD and a Master's degree; 37% of respondents hold a PhD, 35% respondents hold a Master's degree while 28% hold a bachelor’s degree. It should also be noted that all individuals who participated in the survey have access to the internet and the majority (83%) has knowledge of the term e-banking.

Discussion of the results

31As mentioned before, the study started by the evaluation of the measurement model. The VIF is calculated, the values of the load and the external weight for each indicator as well as.

32As shown in Table 1 (the appendix), all the VIFs are lower than five. It means that there is an absence of collinearity between the selected indicators. In other words, it means that the indicators of a given variable in the model are not related to each other in such a way as to influence the indicators of the other variables and thus reduce the reliability of the model.

33Outer loading and outer weight values are contained in Table 2 in the appendix. Generally, the values of the external load must be greater than 0.50 and the external weight less than 0.05. If these two conditions are not met, the indicator should be removed. No indicator has been deleted because we have formative constructs. Deleted indicator of a formatively constructed variable inevitably leads to a reduction of the variable to which this indicator is assigned.

34After evaluating the measurement model, it is necessary to evaluate the structural model by analyzing the relationships between independent and dependent variables, and by testing the developed hypotheses. To examine the relationships between the different variables and to test the original hypotheses, the p-values of each variable and the signs that are associated with their beta coefficients (β) are observed. The results indicate that (table 3):

-

The variable perceived usefulness (PU) negatively but not significantly influences the acceptance of e-banking by university students.

-

The variable perceived ease of use (PEOU) negatively but not significantly influences the acceptance of e-banking by university students.

-

The variable security and confidentiality (SC) have a negative and significant influence on the acceptance of e-banking by university students.

-

The variable previous experience of use (PEU) negatively but not significantly influences the acceptance of e-banking by university students.

-

The variable quantity of information (QI) negatively but not significantly influences the acceptance of e-banking by university students.

-

The variable need for human interaction (NHI) negatively and significantly influences the acceptance of e-banking by university students.

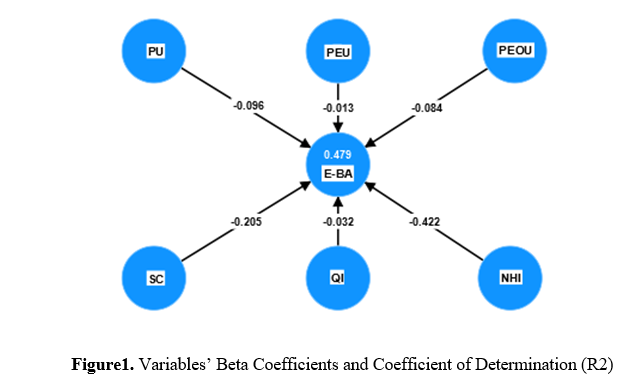

35Based on these results, hypotheses H3 and H6 are confirmed while hypotheses H1, H2, H4 and H5 are rejected.

36After the evaluation of the measurement model and the structural model, we must to calculate the coefficient of determination (R2). The coefficient of determination (R2) gives us information on the predictive relevance of the model. The figure below gives us the value of the R2.

37The R2 value is 0.479, which attests to a moderate predictive relevance of the model. In other words, this R2 value means that the model we have trained explains 47.9% of the variance of e-banking acceptance by university students. This moderate R2 value may be because other factors likely to influence the acceptance of e-banking by university students were not considered.

38In terms of interpreting the results obtained above, we can say that perceived usefulness, perceived ease of use, security and privacy, previous experience of use, amount of information and the need for human interaction are all obstacles to the acceptance of e-banking by university students (all beta coefficients are negative). In other words, university students remain sceptical about the acceptance of e-banking because they find online banking services unhelpful, difficult to use, they also consider that e-banking does not have a reliable security and privacy system and they are afraid that information about their own persons and bank accounts could be hacked via the e-banking system. University students who do not use e-banking are afraid that they could once again be victims of data fraud and hacking of bank accounts. They also consider that they are not sufficiently informed about the advantages and use of e-banking and that the use of e-banking eliminates the human contact between agents and customers in favour of a "machine-customer" relationship. These results confirm “a priori” what was said in the theoretical part and shows the relevance of the results obtained previously.

39Although these six variables are found to be obstacles to the acceptance of e-banking by university students, they are not all significant. The only factors to which they attach increasing importance are security, confidentiality, and the need for human interaction. That is, university students do not accept e-banking because they consider that there is a great lack of security and confidentiality, and that e-banking abolishes human contact in a society where the focus is on the relational. The factors of perceived usefulness, perceived ease of use, previous experience of use, and amount of information are not significant barriers in their eyes.

Conclusion

40The main objective of this research work was to determine the factors inhibiting the acceptance of e-banking by university students. To this end, the research model formed included six (06) independent variables that are perceived usefulness (UP), perceived ease of use (FUP), security and privacy (SC), previous experience of use (PEU), quantity of information (QI) and need for human interaction (BIH).

41The results of the structural equation modelling with the SmartPLS software revealed the significant influence of two (02) variables on the acceptance of e-banking by university students, namely: security and confidentiality (SC) and the need for human interaction (BIH). In other words, among the six variables taken from the literature and introduced in our model, only two (02) seem to apply in the Moroccan context.

42Security and confidentiality (SC) significantly and negatively influences the acceptance of e-banking by university students; this suggests that the worse the security and confidentiality conditions are, the less individuals will accept e-banking. The need for human interaction (BIH) significantly and negatively influences the acceptance of e-banking by university students; this implies that university students do not accept e-banking because e-banking prevents them from being in contact with their counterpart.

43 A number of recommendations can be extracted from the study’s findings for the benefit of companies that have adopted e-banking. Indeed, by looking at the study’s results, the managers of banking institutions can review their strategy for promoting e-banking. Regarding the issue of security and privacy, the management of banking institutions should develop strategies to guide the customers and to inform them about the do's and don'ts of e-banking. This is particularly necessary because customers tend to have problems with security and data privacy as a result of them not know the proper way to react in fraud scenarios. Consequently, bank managers should take measures to inform and to train customers to be aware of and to behave accordingly. Moreover, banks should provide customers with services deployed to repair the damage caused by security problems. However, it should be noted that even if bank managers develop some strategy to reassure customers about the security and confidentiality of e-banking, it is difficult, if not almost impossible, to guarantee the security and confidentiality of a system, let alone to change an individual's beliefs and convictions.

44With regard to the need for human interaction, the study’s findings show that, despite the advantages of e-banking and the use of the internet is widespread in Morocco, university students are not yet prepared for 100% conversion to the digital. Accordingly, it would be wise for Moroccan banks to offer e-banking services while at the same time sustaining traditional banking services, as there will always be this cultural constraint, as Morocco is a country where human contact and relationships are of great importance.

45On the other hand, the study has a number of limitations in both theory and practice. Indeed, previous research has shown that clients differ in terms of socio-demographic variables such as gender, age group, education level and income level. One of the limitations of this study is that these moderating variables were not included in the analysis. We can also mention the size of the sample and the fact that only students for Hassan first university were included in the sample, which makes it difficult to generalise the results to the whole population. It should also be noted that this study did not take into account other variables that could also negatively influence the acceptance of e-banking. Future studies can be carried out taking into account these variables, and simultaneously considering the effect e-banking can have on society and the social problems it may raise.

Appendix

Table 1. VIF of each indicator

|

Variables |

Indicators |

VIF |

|

Perceived Utility (PU) |

PU1 |

1.443 |

|

PU2 |

2.937 |

|

|

PU3 |

2.951 |

|

|

PU4 |

2.645 |

|

|

PU5 |

2.377 |

|

|

PU6 |

1.525 |

|

|

Perceived Ease Of Use (PEOU) |

PEOU1 |

1.753 |

|

PEOU2 |

2.708 |

|

|

PEOU3 |

2.128 |

|

|

PEOU4 |

1.901 |

|

|

PEOU5 |

1.549 |

|

|

PEOU6 |

2.273 |

|

|

Security and Confidentiality (SC) |

SC1 |

1.477 |

|

SC2 |

3.305 |

|

|

SC3 |

3.306 |

|

|

SC4 |

2.066 |

|

|

SC5 |

3.638 |

|

|

SC6 |

2.708 |

|

|

Previous Experience of Use (PEU) |

PEU1 |

2.007 |

|

PEU2 |

2.007 |

|

|

The Quantity of Information (QI) |

QI1 |

1.475 |

|

QI2 |

1.475 |

|

|

The Need for Human Interaction (NHI) |

NHI1 |

1.418 |

|

NHI2 |

1.432 |

|

|

NHI3 |

1.076 |

Table2. Values of outer loading and outer weight

|

Variables |

Indicators |

Outer loading |

Outer weight |

Decision |

|

Perceived Utility (PU) |

PU1 |

0.209 |

-0.181 |

To maintened |

|

PU2 |

0.570 |

-0.084 |

To maintened |

|

|

PU3 |

0.580 |

0.122 |

To maintened |

|

|

PU4 |

0.687 |

0.761 |

To maintened |

|

|

PU5 |

0.402 |

-0.482 |

To maintened |

|

|

PU6 |

0.845 |

0.811 |

To maintened |

|

|

Perceived Ease Of Use (PEOU) |

PEOU1 |

0.501 |

-0.081 |

To maintened |

|

PEOU2 |

0.935 |

0.854 |

To maintened |

|

|

PEOU3 |

0.605 |

-0.035 |

To maintened |

|

|

PEOU4 |

0.686 |

0.200 |

To maintened |

|

|

PEOU5 |

0.717 |

0.340 |

To maintened |

|

|

PEOU6 |

0.555 |

-0.213 |

To maintened |

|

|

Security and Confidentiality (SC) |

SC1 |

0.480 |

0.027 |

To maintened |

|

SC2 |

0.725 |

-0.143 |

To maintened |

|

|

SC3 |

0.879 |

0.804 |

To maintened |

|

|

SC4 |

0.651 |

0.194 |

To maintened |

|

|

SC5 |

0.636 |

-0.552 |

To maintened |

|

|

SC6 |

0.843 |

0.722 |

To maintened |

|

|

Previous Experience of Use (PEU) |

PEU1 |

0.976 |

0.760 |

To maintened |

|

PEU2 |

0.844 |

0.306 |

To maintened |

|

|

The Quantity of Information (QI) |

IQ1 |

0.936 |

0.694 |

To maintened |

|

IQ2 |

0.821 |

0.427 |

To maintened |

|

|

The Need for Human Interaction (NHI) |

NHI1 |

0.788 |

0.417 |

To maintened |

|

NHI2 |

0.857 |

0.550 |

To maintened |

|

|

NHI3 |

0.575 |

0.348 |

To maintened |

Table 3. P-values and beta coefficients (β)

|

Relations |

p-values |

Coefficients beta (β) |

|

PU->E-BA |

0.481 |

-0.096 |

|

PEOU->E-BA |

0.461 |

-0.084 |

|

SC->E-BA |

0.048* |

-0.205 |

|

PEU->E-BA |

0.903 |

-0.013 |

|

QI->E-BA |

0.766 |

-0.032 |

|

NHI->E-BA |

0.000* |

-0.422 |

Bibliographie

Abi-Rizk, D.G. (2006). « L’Internet au service des opérations bancaires et financières », Ph.D thesis, Pantheon-Assas University (Paris II),

Aboobucker, I., & Bao, Y. (2018). What obstruct customer acceptance of internet banking? Security and privacy, risk, trust and website usability and the role of moderators. The Journal of High Technology Management Research, 29(1), 109-123.

Ailli, S. (2014). Pratique de l’e-banking par la clientèle bancaire (particuliers) au Maroc: contraintes et opportunités marketing. Revue Marocaine de Recherche en Management et Marketing, (9-10).

Ajzen, I. (1991). The theory of planned behavior. Organizational behavior and human decision processes, 50(2), 179-211.

Ajzen, I., & Fishbein, M. (1975). A Bayesian analysis of attribution processes. Psychological bulletin, 82(2), 261.

Al-Jabri, I. M., & Sohail, M. S. (2012). Mobile banking adoption: Application of diffusion of innovation theory. Journal of electronic commerce research, 13(4), 379-391.

Amin, H. (2007). An empirical investigation on consumer acceptance of internet banking in an Islamic Bank. Labuan Bulletin of International Business and Finance (LBIBF), 5, 41-65.

Bellahcene, M., & Khedim, M. M. (2016). Les facteurs influençant l’adoption de l’e-banking par les clients des banques algériennes. Economie & Société, 12, 71–85

Benamar, B., & Cheriet, F. (2012). Les déterminants de l’innovation dans les entreprises émergentes en Algérie. Innovations, (3), 125-144.

Bennaceur, A., & Chafik, K. (2019). Les fondements de l’usage des équations structurelles dans les recherches en sciences de gestion: Cas de l’approche PLS. Revue du Contrôle, de la Comptabilité et de l’Audit, 3(2), 733-753.

Berdi, A., & Bouarfa, J. (2018). L’utilisation des technologies d’information et de communication (tic) dans le secteur bancaire marocain: état des lieux et clés de succès. Revue Economie, Gestion et Société, (17).

Bulletin Officiel. (2004). Loi n° 07-03 promulguée par le dahir n° 1-03-197 du 11 novembre 2003 – 16 ramadan 1424 modifiant et complétant le Code pénal.

Cheikho, A. (2015). L’adoption des innovations technologiques par les clients et son impact sur la relation client-Cas de la banque mobile (Doctoral dissertation, Université Nice Sophia Antipolis).

Chun, S. H. (2011). Smart mobile banking and its security issues: from the perspectives of the legal liability and security investment. In Future Information Technology: 6th International Conference, FutureTech 2011, Loutraki, Greece, June 28-30, 2011, Proceedings, Part I (pp. 190-195). Springer Berlin Heidelberg.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 319-340.

France. Centre d'analyse stratégique, Klein, T., & Ratier, D. (2012). L'impact des TIC sur les conditions de travail. Paris: La Documentation française.

George, J. F. (2004). The theory of planned behavior and Internet purchasing. Internet research, 14(3), 198-212.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing theory and Practice, 19(2), 139-152.

Halime, Z. F. & Kirmi, B. (2017). Étude de la résistance à l’adoption et l’utilisation de la banque mobile : cas du Maroc. International Journal of Business and Economy Strategy, 62-72

Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. In New challenges to international marketing. Emerald Group Publishing Limited.

Hosein, N. Z. (2009). Internet banking: An empirical study of adoption rates among Midwest community banks. Journal of Business & Economics Research (JBER), 7(11).

Ilyas, A., Danish, R. Q., Nasir, F. H. H., Malik, M. R., & Munir, S. (2013). Factors affecting the customer acceptance of e-banking in Pakistan. Journal of Basic and Applied Scientific Research, 3(6), 474-480.

Khedim, M., M. (2016). L’adoption des systèmes d’information : l’utilisation de l’e-banking dans le contexte algérien (Master dissertation, Université Abou Belkaid Tlemcen).

King, W. R., & He, J. (2006). A meta-analysis of the technology acceptance model. Information & management, 43(6), 740-755.

Laukkanen, T., Sinkkonen, S., Kivijärvi, M. and Laukkanen, P. (2007), "Innovation resistance among mature consumers", Journal of Consumer Marketing, Vol. 24 No. 7, pp. 419-427.

Lee, K. C., & Chung, N. (2009). Understanding factors affecting trust in and satisfaction with mobile banking in Korea: A modified DeLone and McLean’s model perspective. Interacting with computers, 21(5-6), 385-392.

Leow, H. B. (1999). New distribution channels in banking services. Banker’s Journal Malaysia, 110, 48-56.

Luarn, P., & Lin, H. H. (2005). Toward an understanding of the behavioral intention to use mobile banking. Computers in human behavior, 21(6), 873-891.

Machkour, B., & Abriane, A. (2022). Les facteurs d’adoption des solutions digitales bancaires par les consommateurs marocains. International Journal of Accounting, Finance, Auditing, Management and Economics, 3(1-2), 549-568.

Marr, N. E., & Prendergast, G. P. (1993). Consumer adoption of self‐service technologies in retail banking: is expert opinion supported by consumer research?. International Journal of Bank Marketing, 11(1), 3-10.

Masood, Q. T., Zafar, M. K., & Khan, M. B. (2008). Customer acceptance of online banking in developing economics. Journal of Internet Banking and Commerce, 13(1), 5-9.

Mathieson, K. (1991). Predicting user intentions: comparing the technology acceptance model with the theory of planned behavior. Information systems research, 2(3), 173-191.

Merbouti, A., & Mestour, O. (2020). La banque en ligne (e-banking): état des lieux en Algérie (Doctoral dissertation, Université Mouloud Mammeri).

Mlaiki, A. (2012). Compréhension de la continuité d'utilisation des réseaux sociaux numériques: Les apports de la théorie du don (Doctoral dissertation, Université Paris Dauphine-Paris IX).

Mojalefa, T. (2013). Factors influencing adoption electronic banking. Mémoire de Magister : Management des affaires : Université de Johannesburg.

Ndangwa, L. (2021). Les freins à l’adoption des services mobiles bancaires par le consommateur camerounais: une application du modèle d’acceptation de la technologie (MAT). Revue Congolaise de Gestion, (1), 43-82.

Odumeru, J. A. (2012). The Acceptance of E-banking by Customers in Nigeria. World Review of Business Research, 2(2), 62-74.

Phuangthong, D., & Malisawan, S. (2005, August). A study of behavioral intention for 3G mobile Internet technology: Preliminary research on mobile learning. In Proceedings of the Second International Conference on eLearning for Knowledge-Based Society (pp. 4-7).

Pousttchi, K., & Schurig, M. (2004, January). Assessment of today's mobile banking applications from the view of customer requirements. In 37th Annual Hawaii International Conference on System Sciences, 2004. Proceedings of the (pp. 10-pp). IEEE.

Rachid, E. L., & Azizi, R. (2020). E-Banking Aspect législatif. Revue Internationale du Chercheur, 1(2).

Riemenschneider, C. K., Harrison, D. A., & Mykytyn Jr, P. P. (2003). Understanding IT adoption decisions in small business: integrating current theories. Information & management, 40(4), 269-285.

Sarstedt, M., Ringle, C. M., Smith, D., Reams, R., & Hair Jr, J. F. (2014). Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers. Journal of family business strategy, 5(1), 105-115.

Sathye, M. (1999). Adoption of Internet banking by Australian consumers: an empirical investigation. International Journal of bank marketing, 17(7), 324-334.

Shaikh, A. A., & Karjaluoto, H. (2015). Mobile banking adoption: A literature review. Telematics and informatics, 32(1), 129-142.

Srijumpa, R., Chiarakul, T., & Speece, M. (2007). Satisfaction and dissatisfaction in service encounters: retail stockbrokerage and corporate banking in Thailand. International Journal of Bank Marketing.

Sylla, I. (2009). Les collectivités locales face au défi du numérique: le cas des communes d'arrondissement de l'agglomération de Dakar (Doctoral dissertation, Université de Toulouse 2).

Taylor, S., & Todd, P. (1995). Decomposition and crossover effects in the theory of planned behavior: A study of consumer adoption intentions. International journal of research in marketing, 12(2), 137-155.

Thompson, R. L., Higgins, C. A., & Howell, J. M. (1991). Personal computing: Toward a conceptual model of utilization. MIS quarterly, 125-143.

Tournois, N. (2002). Le marketing bancaire face aux nouvelles technologies : Le

contexte de l'aube du troisième millénaire. Tome 1. S.l. :éd e-theque.99 p. ISBN : 2-

7496-0028-6

Triandis, HC. (1980). Réflexions sur les tendances de la recherche interculturelle. Journal de Psychologie Interculturelle, 11 (1), 35-58.

Venkatesh, V., & Brown, S. A. (2001). A longitudinal investigation of personal computers in homes: Adoption determinants and emerging challenges. MIS quarterly, 71-102.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS quarterly, 425-478.

Zahid, N., Mujtaba, A., & Riaz, A. (2010). Consumer acceptance of online banking. European Journal of Economics, Finance and Administrative Sciences, 27(1), 2010.

Pour citer ce document

Ce(tte) uvre est mise à disposition selon les termes de la Licence Creative Commons Attribution 4.0 International.